Source: Zero Hedge

For all the newly hatched virtue-signaling “climate change warriors”, starting with Greta Thunberg of course, we have just one message: please take your complaints to Beijing (if you dare).

As Goldman’s Chinese economists write, to date, over 120 countries have announced targets to cut greenhouse gas (GHG) emissions and China’s recent commitment “may be one of the most ambitious”, if not most ridiculous. At the United Nations General Assembly last September, President Xi Jingping pledged that China is targeting peak CO2 emissions by 2030 and carbon neutrality by 2060. At the Fifth Plenum of the 19th Party Congress last October, discussions around the 14th Five-Year Plan and China’s long-term goals outlined stabilizing and falling carbon emissions by 2035. Last December, the government issued a white paper titled “China’s energy development in the new era”, and in February 2021, the State Council released the guidance for building a green low-carbon economic system.

While it is clear that China has – at least in theory – begun to lay the ground for achieving net zero emissions over the next four decades, the question is how much of this is just a virtuous smokescreen to shut up critics. In response, Goldman analysts have done extensive work on this topic, modeling the technological paths to net zero sector by sector, from renewable power to electric mobility, and from hydrogen to carbon capture, to we provide a macro perspective and look at the economics of China de-carbonization given the unique challenges it faces and the advantages it has.

As Goldman summarizes, “there is little doubt that “Carbon Neutral 2060” will be an enormous undertaking given China’s natural endowment of coal, China’s economic structure of being an industrial powerhouse and its current stage of economic development.” That said, features of its political and economic system also suggest that China may be better positioned to take on the challenge than other countries. In the case of China, Goldman expects a two-step multi-speed approach where most of the emission-cutting takes place after 2035 and different sectors and regions proceed at different paces.

While nobody can predict what happens in 40 years, one thing is clear: there can be “no global solution without China.”

Goldman writes that solving the problem of “climate change” requires drastic decreases in global greenhouse gas emissions. But cutting global emissions is also extremely challenging because of various externalities (e.g., the cost of one country’s emissions may be borne by people in another country) and collective action failures (e.g., polluting activity may move from high carbon tax jurisdictions to low carbon tax jurisdictions). In this context, China will need to be an integral part of any solution to the climate change problem.

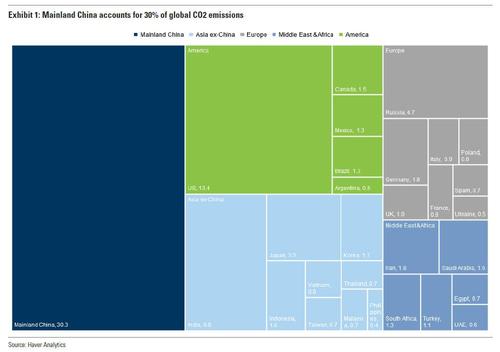

Why? Because with China accounting for 30% of the world’s total CO2 emissions, Goldman writes that “no global solution is viable without China.”

Some more details from Goldman:

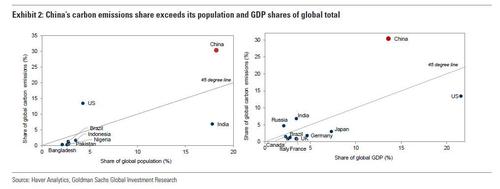

Relative to its global shares of population and GDP, China emits significantly more CO2 (Exhibit 2). There are two reasons for this.

- First, China is rich in coal and coal generates much more CO2 than natural gas for every unit of electricity produced. For example, coal accounts for 68% of China’s electricity supply vs. 29% in the US and 21% in the European Union.

- Second, China’s economic structure is more energy-intensive than many other countries. For example, for every Yuan of GDP produced, the secondary industry (industrials) consumes three times as much electricity as the tertiary industry (service) in China. Despite the ongoing progress in expanding the service sector, the secondary industry is still 39% of China’s GDP, compared to only 18% in the US.

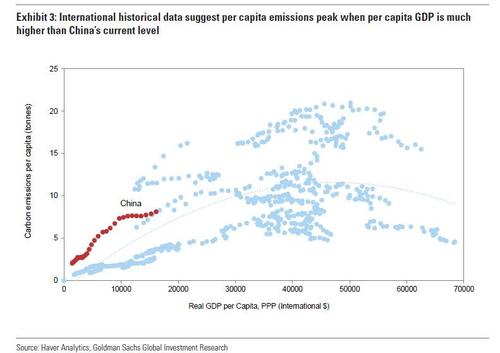

Besides the difficulties originated from its economic structure, China’s development stage imposes additional challenges to its de-carbonization efforts. The next chart shows the relationship between per capita GDP and per capita emissions over 1990-2019 data for 20 major economies. Initially, as GDP increases from a low level, emissions rise accordingly, and it is only after GDP per capita reaches around $40,000 in PPP terms – which was the level for the US in 1990 and Japan in 2015 – do emissions per capita begin to stabilize and decline. That turning point is about 2.5 times of China’s current per capita GDP. That means that realistically, Chinese CO2 emissions are set to double in the coming years!

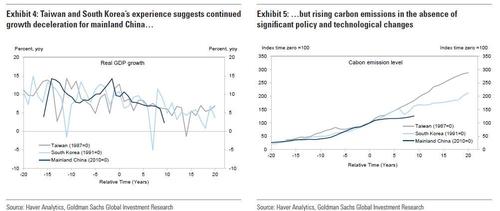

Given the significant differences across economies, Goldman also compare mainland China with Taiwan and South Korea, two economies that share similar culture and economic structure to China. It aligned the mainland China economy in 2010 with Taiwan’s in 1987 and South Korea’s in 1991, as these years marked the respective times when GDP growth started to decelerate notably. Exhibit 4 shows that mainland China’s GDP growth has been tracking the experience of Taiwan’s and South Korea’s closely and may average around 5% over the next 10 years. Exhibit 5 shows that, if mainland China’s carbon emissions were to also follow Taiwan and South Korea’s experience, they would increase significantly over the coming decade in the absence of drastic policy changes and/or technological breakthroughs.

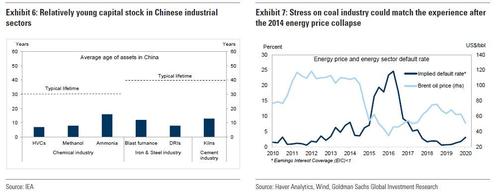

There are many other obstacles faced by China, including the relatively young capital stock and potentially bigger financial spillover effects. On capital stock, the International Energy Agency (IEA) estimates that the average age of assets in Chinese chemical, iron and steel, and cement industries is only around 10 years, while the typical lifetime of these assets is 30-40 years (Exhibit 6). Replacing relative young capital stock is more likely to create stranded assets and generate negative wealth effects.

On financial spillovers, because of China’s heavy reliance on coal for energy, coal mining and coal-fired power utilities also account for a significant share of total bank lending in China – approximately 5% – compared to other countries (e.g., 1% in Japan and South Korea). If demand for coal were to contract rapidly, many coal mines and coal-fired power plants could become insolvent, raising the potential for default on their loans and bonds. Some researchers have suggested that default rates among coal miners could exceed 20% by 2030. Under this scenario, the sector would come under as much stress as when energy prices collapsed in 2014 (Exhibit 7).4 The losses on bank loans could ultimately reduce real GDP by 1pp based on Goldman estimates of the links between NPLs, bank lending, and economic growth.

While there are various other observations in the full Goldman report (available in the usual place), the bank’s conclusion is that in its pursuit of a “multi-speed approach”, Beijing needs to strike a balancing act in nachieving net zero emissions: too fast a change may derail other policy goals such as doubling income by 2035, but moving too slowly could lead emissions to peak at too high a level. The first of the two steps features low-cost abatement measures such as renewable power and waste/recycling as well as R&D investment to improve abatement technologies. Higher-income regions within China with a low energy intensity of output can afford to move first and their focus is likely to be on the transportation sector.

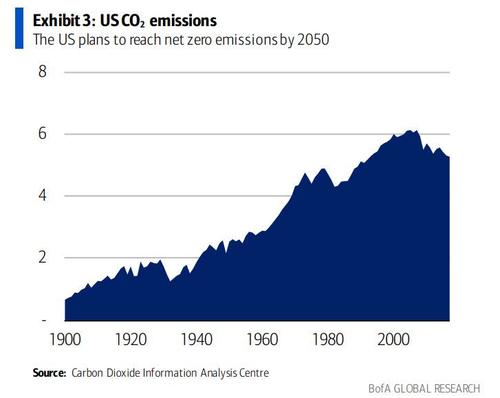

The bottom line is that as with everything else, whatever China states in public, what happens in reality is usually the opposite. Which is why all those hoping that Beijing will hold true to its promise of carbon neutrality by 2060… will be disappointed. It’s also why the true environmentalists – and not those poseurs hoping for a quick popularity or SnapChat boost – are encouraged to bring their complaints and laments to China and to stop focusing so much on the US…

… whose emissions are now at a three decade low and dropping fast.